With an EPO, you can just get services from suppliers within a specific network. Nevertheless, exceptions can be made for emergency care. Another characteristic of an EPO plan is that you might be needed to choose a main care physician (PCP). This is a family doctor who will supply preventative care and treat you for small illnesses. In addition, with an EMO plan, you normally do not need to get a referral from your PCP in order to see a specialist physician. A high-deductible health plan (HDHP) has a number of key characteristics. As its name indicates, it has a greater yearly deductible than other insurance coverage strategies.

High-deductible health strategies typically have lower monthly premiums. This kind of strategy is perfect for young or normally healthy people who do not anticipate to require health care services unless they experience a medical emergency situation or an unexpected accident. What is mortgage insurance. The last specifying function of a high-deductible health insurance is that it uses access to a tax-advantaged Health Cost savings Account (HSA). An HSA is an account that customers can contribute funds to that can later on be used for medical expenses that their high deductible health insurance doesn't cover. The benefit of these accounts is that the funds are not subject to federal income taxes at the time of the deposit.

A portion of services that customers receive is spent for with pre-tax dollars. Like other high-deductible health care plans, consumer-driven health insurance have greater annual deductibles than other medical insurance plans but the customer pays lower premiums each month. A point of service (POS) plan supplies different benefits to subscribers based upon whether they utilize preferred service providers (in-network suppliers) or providers beyond the preferred network (out-of-network suppliers). A POS strategy includes features of both HMO strategies and PPO plans. A short-term insurance coverage policy covers any gap you might experience in protection if, for instance, you alter tasks and your brand-new company strategy does not start immediately.

The Only Guide to How Much Is Life Insurance

Term lengths differ by state, and in some U.S. states, you may be qualified for a short-term strategy for approximately 12 months. Short-term health insurance coverage is likewise called temporary health insurance coverage or term health insurance coverage. It can be useful if you're changing jobs, waiting to become qualified for Medicare protection, or suffering the designated open registration duration for a plan. Under a short-term insurance strategy, your partner and other eligible dependents may also be covered. However, one important caution of a short-term insurance plan is that sometimes, pre-existing conditions can disqualify you from coverage. The definition of a pre-existing condition differs depending upon the state you live in, but it is usually specified as something you have been detected with or gotten treatment for within the last 2 to 5 years.

In order to qualify, you must receive a difficulty exemption from the federal government. Catastrophic medical insurance generally has lower premiums than other medical insurance strategies. These kinds of plans are planned for individuals who can not afford to invest quite cash each month on insurance premiums but who don't want to be without insurance coverage in case of a major mishap or illness. While disastrous medical insurance plans might have low regular monthly premiums, they typically have the greatest possible deductibles. Once you have actually chosen on the kind of plan that is best for you, you'll need to identify just how much you can afford to pay as a deductible.

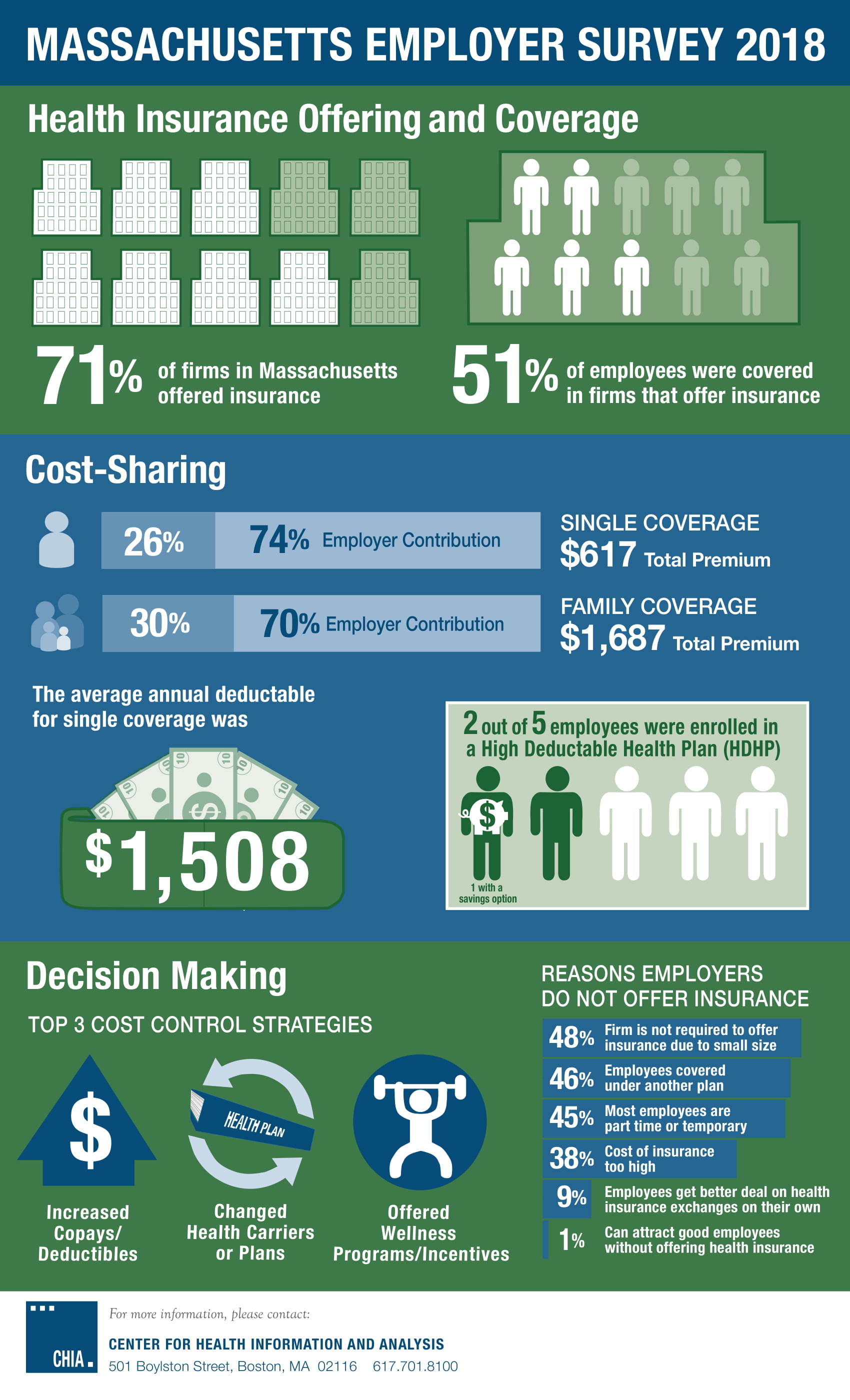

What can you afford to pay in out-of-pocket medical expenses each year? With many medical insurance plans, the higher your deductible is, the lower your month-to-month premium will be. If your month-to-month cash circulation is low, you may timeshare maintenance fees need to go with a greater deductible. Another crucial factor to consider when selecting an insurance strategy is the plan's out-of-pocket optimum. After you've spent this amount on deductibles and medical services through co-payments and co-insurance, your health insurance will pay the entire expense of covered advantages. While many individuals are terrified by the possibility of buying their own insurance versus registering in an employer-sponsored plan, some studies have actually shown that it can wind up being more cost effective than employer-sponsored plans.

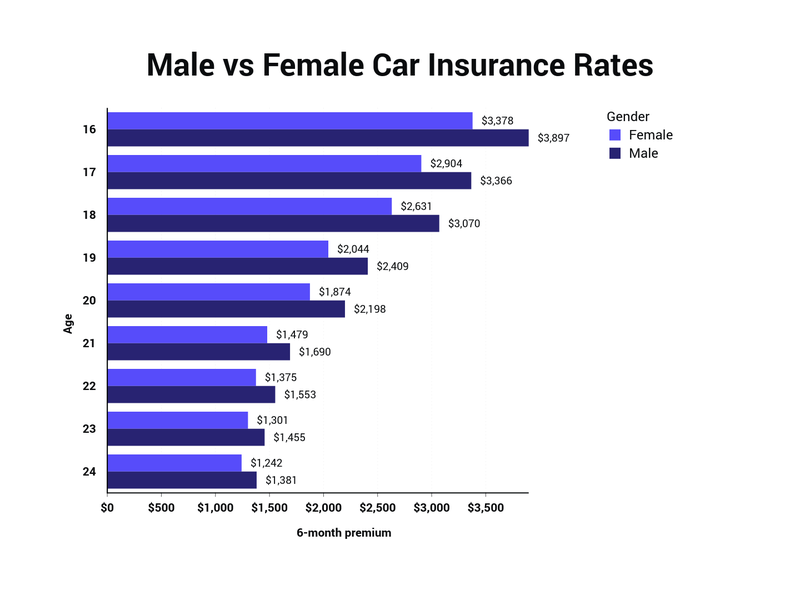

Some Of How Much Does Car Insurance Cost

It was $1,725 for family coverage. Alternatively, according to the Kaiser Household Structure, if you were to purchase your own insurance coverage beyond an employer-sponsored strategy, the typical expense of private medical insurance was $440. For households, the typical regular monthly premium was $1,168. In addition, if you end up acquiring coverage through the Medical insurance Marketplace, you might receive a Cost-Sharing Decrease aid and Advanced Premium Tax Credits. These can decrease the quantity you spend for premiums, in addition to decreasing your deductible, and any co-payments and co-insurance you are responsible for. You have several alternatives best company to sell timeshare when it comes to buying private health insurance.

It is suggested that you see what the basic Medicare strategy covers and then look at alternatives for ways to supplement Medicare through Medigap and Medicare Advantage policies. When considering Medigap or Medicare Advantage protection, it is very important to comprehend how both work kinds of protection work in conjunction with standard Medicare protection (What is universal life insurance). As an outcome of the Affordable Care Act (ACA), the Health Insurance Market was produced in 2014. You can go to the Health Insurance coverage Marketplace website to find out more about the alternatives for medical insurance protection that are available where you live. You can also determine if you certify for any subsidy and make an application for it.

Usually, it is between November 1 and December 15 every year, although numerous events may cause the open registration period being extended or resumed. On Jan. 28, 2021, President Joe Biden signed an executive order to implement an Unique Registration Duration, reopening the federal insurance coverage market (healthcare. gov) from Feb. 15 through May 15, 2021. The site includes details about private plans that are offered for purchase beyond the Marketplace. Nevertheless, if you purchase a strategy outside the ACA's Market, whether throughout open enrollment or not, you will not be eligible for any aids offered under the ACA.

5 Simple Techniques For What Does Gap Insurance Cover

This is called a Special Registration Period. You may http://juliusbrre692.lowescouponn.com/3-simple-techniques-for-how-to-get-health-insurance be qualified for a Special Enrollment Duration if you experience a family change, including marrying or divorced, having or embracing a child, a death in your family, moving, losing your health insurance, being in a nationwide disaster, or experiencing an impairment. The American Rescue Strategy of 2021 increased aids for ACA prepare for lower-income Americans and broadened subsidies to include some subsidies at greater earnings levels. You can check out the websites of significant medical insurance business in your geographical region and search available choices based upon the kind of coverage you choose and the deductible you can manage to pay.